HERE WE GO... into 2019

Reviewing the past year, Reflecting, and my Predictions

As we near the end of 2018, I would like to take a moment to review my 2018, but not too long. I also encourage you to take a few hours, sit down with a glass of red wine, and ponder what took place in your life over the past year.

At the end of 2017, I was working for a company in the middle of cleaning up an ethical mess crafted by the then unethical owners. During the 1st QTR of 2018, I advised the employees towards the creation of a new operating entity. Over the next QTR, a new employee owned company was created and off it went... It's been a great year for the new company and for Front Porch Advisers as well.

2018 also saw a lot of changes in our family. We welcomed kidos into our home in mid August and are looking to finalize their adoption sometime in 2019. If you'd like to learn more about our story, you can read the recent article published in the Cherokee Tribune and/or visit our website or Facebook page.

For me, 2018 was my "Enlightenment" year. I read several books that heavily influenced my outlook on the world, life, our future, what I/we need to do, and feel better prepared as a result.

Here are a few of the highlights:

PODCASTS

I love listening to podcasts while in the car, at the gym, mowing the yard, etc. If you are not currently a podcaster, make that a resolution for 2019.

The FEATURED VOICES podcast is the work of Chris Martenson, an economic researcher and futurist specializing in energy and resource depletion, and co-founder of PeakProsperity.com, ( with Adam Taggart). He is also the author of The Crash Course which I highly recommend. My favorites of 2018 were his discussions with Dr. Charles Hall (UNC), David Cullom (Cornell), and Stephen Jenkinson. I love the podcast but hope he gets some new topics for 2019.

If you aren't listening to Joe Rogan's podcast, "why the F&$% not?"... Not only is Joe waaaayy smarter than you think, he's able to conduct some long form discussions with some very smart people. Some of my favorite guests of his are Jordan Peterson (#1070, 1139, 1208.. he likes this guy too), Bret Weinstein (#1081) , Neil Degrasse Tyson (#1159), Peter Schiff (#1145). Jordan Peterson and Bret Weinstein are 2 of my "smartest people" of 2018 and I think Peter Schiff is one of the "real" voices of the actual US Economy.

READS

I read several books in 2018, these were my favorites... as you'll notice, I do not read fiction.

At the end of 2017, I was introduced to David Collum via Peak Prosperity. 10 years ago, David (a Chemistry professor at Cornell) began writing his "Year in Review." It centers on comical yet factual financial and political highlights from the past year. It is a must read for anyone that cares about politics, economics, and enjoys some vulgarity in their jokes. I am in the middle of his 2018 Year in Review which is also being read by some of the most powerful people in the economy. Here is a link to the 231 page PDF, I read it on a tablet to save paper.

An American Sickness was written by Elisabeth Rosenthal. Be prepared if you have a chronic condition, this book may piss you off. However, it will also help you navigate our complex and often challenging healthcare system. I loved this book and have already handed it off to someone else to read. If you plan to visit the doctor in 2019, read this...

Everybody loves Ron Paul, right? I always liked and respected the guy while he was serving in Congress but after reading his book, I have a new found respect for what he expected to accomplish prior to beginning his first term in office. I have always fancied myself a closet Libertarian but after finished this book, I "came out," and am now an uncloseted supporter.

If you are concerned about where you stand on certain issues, you should read this, and consider your stance. I have also already handed this book off to someone else.... Every American should read Liberty Defined.

After thinking about all the books I read this year and the podcasts I heard, I realized that most of it centered on me discovering how to think and process complex topics on my own and communicating those opinions to people that I met. I hope that I became a better communicator in 2018 and look forward to learning and discussing more in 2019.

PREDICTIONS FOR 2019

Fine Print: I am NOT an economist by higher education and am not licensed in the financial planning industry. I also did not stay at a Holiday Inn Express last night; therefore, please take my commentary as "common sense" and not expert content.

Unfortunately, these are not going to be incredibly positive... but I secretly hope at least 1 of them comes true. You can accuse me of being a masochist if you like, but the longer we wait, the more painful it will be...

The ECONOMY

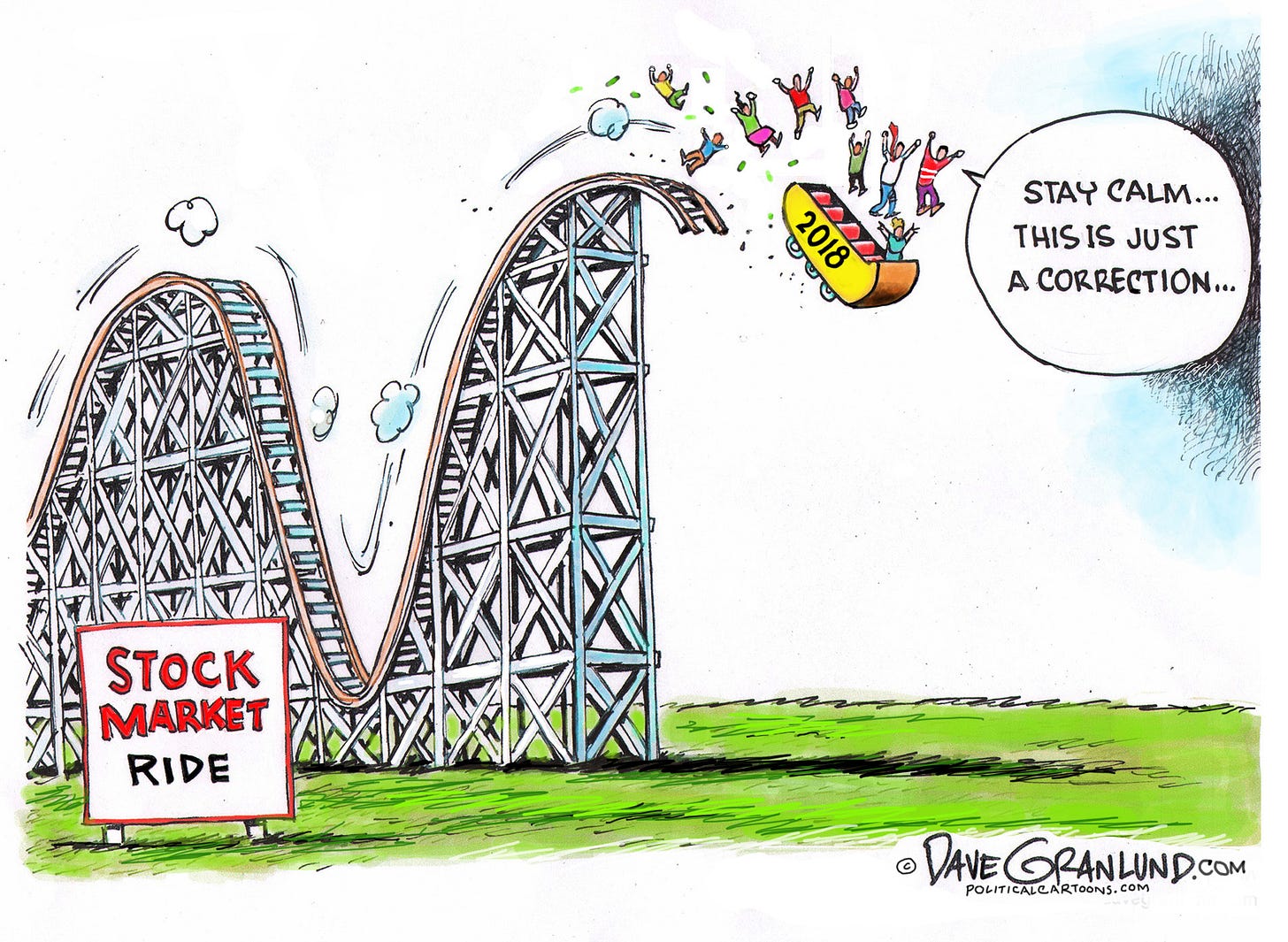

Late last year, I became more verbal about my thoughts on the economy and my predictions. I still feel very much the same way... I originally said that we would see a step down correction over the next few years so that the general public wouldn't freak out as much as 2008 and the banks could put their excess liquidity to work (aka buying/investing in lots of stuff at lower prices). This would likely come in a market correction to the mean in all areas of the economy (the markets, real estate, commodity prices, etc.). I could see that equating to a 30 to 40% drop. The other alternative could be the correction of all corrections thru the mean equating to a 50-60% drop across the board. No one could say when exactly it will happen, but I think the end of 2018 is a good barometer for 2019. Lower markets and uncertainty about the future.

I along with Peter Schiff and several other folks way smarter than me, also believe that we never actually ended the recession of 2008. We have spent the last 10 years on a Federal Reserve Bank sponsored Economic Vacation to an all inclusive resort where most vacationers (aka Americans) became oblivious. Many citizens sat back in their lounger by the pool, ordered another drink, put the entire vacation on the Amex, bought a larger house, and established a HELOC (Home Equity Line) to pay for the $100k of shiplap or a wood accent wall that Joanna Gaines inspired to every F&^%*NG room. People have gone right back to their pre-2008 way of life and think all is going great.... WRONG!!!

As a side note and if you haven't already figured this out, I am a firm believer in Austrian Economics. Keynesian theories have governed our economy for too long and are now showing their teeth.

There are a countless number of reasons why I believe we will see a correction very soon. Here's my "Top 5" (in no particular order of priority) reasons why I think we are due for a correction in 2019:

#1. An Inverted Yield Curve:

If you are not familiar with the idea of the Yield Curve between various Treasuries, you need to be. It has been somewhat good at predicting pending recessions upon inversion. Click this for a good layman's explanation. The inverted yield curve does NOT necessarily mean that we are going into a recession as is has proven some false positives over its history; however, an inverted yield curve is always a negative economic indicator. The Yield Curve(s) inverted on December 3rd, 2018.

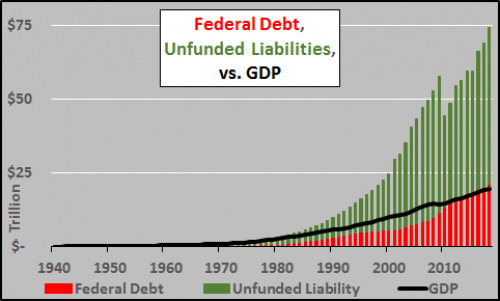

#2. Debt:

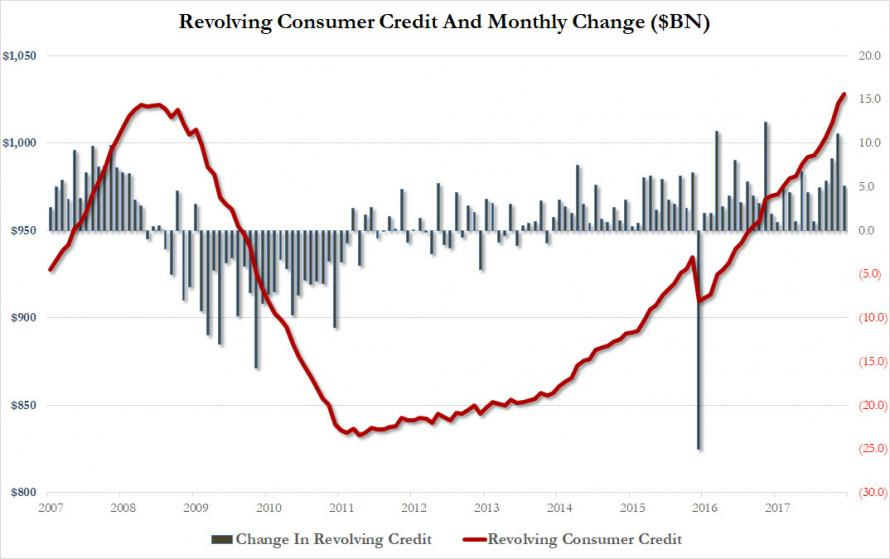

We live in a debt based economy. The world has moved forward at a staggering rate due to the ability to obtain cheap credit. When a company or an individual can borrow money at 3-4% (or less) and get 6-8% (or more) returns for an extended period (10 years), there is very little incentive for a company or an individual to live in a cash flow positive budgetary model until rates go up or returns go down.

What happens when they both happen at the same time (rates up, returns down)? We may find out soon...

The # below is the current and growing US National Debt:

https://wwwd.house.gov/apps/debtclock/iframe.html

Since I am primarily a Kinesthetic learner, I prefer to learn by doing. This also means I am more of a visual person, which is why I love the following infographics (several are from from Visual Capitalist).

When the FED lowered interest rates in the wake of the 2008-2009 financial collapse, they essentially make it easier for Corporations and Families to go further into debt without feeling the pain of nominal interest payments. In my opinion, the FED should've left rates alone and let the free market determine the future. Yes it would have gotten MUCH worse without massive intervention from the FED, but I believe we kicked the can down the road and the the worst may be yet to come.

Here is a visual of World Debt Growth:

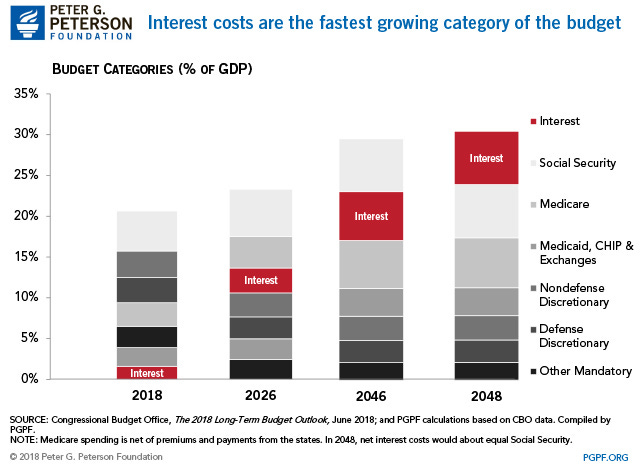

Presently, Interest is the 3rd highest combined Expense for the Federal Government behind #1. Total Entitlement Costs (Medicare, Social Security, Welfare, etc.) and #2. National Defence (aka The Military). For Fiscal Year (FY) 2019, the US will operate under a $985B deficit (FY 2019 covers October 1, 2018, through September 30, 2019).

As debt grows and rates increase, interest costs will continue to increase and are projected to be the third largest (smaller) category in the federal budget by 2026 (after Social Security and Medicare), the second largest category in 2046, and the single largest category by 2048 (see chart below). Basically, we will no longer have enough income to cover our expenses and will need a good bankruptcy attorney or the 2nd Coming of Christ to prevent something really bad from happening.

Here are some other staggering visuals to illustrate the severity of The US and the International Sovereign Debt:

Household debt is not any prettier, it has also increased steadily since 2011.

During the next correction, my hope will be that the US population will slow its consumption and rely less on debt for purchases (aka buying power). Lowering consumption will also allow the US to conserve more of our natural resources for future generations. If you equate US Debt (sovereign and private) to your Credit Card, you likely would have recently received an "approaching your credit limit" alert. The economy cannot continue to "apply for a credit limit increase" vs actually focusing on the problem, reducing spending/expenses.

#3. Charles Schwab suggests shorting the market...

In December 17th, 2018, @tommythornton Tweeted out the video of a Charles Schwab advisor commenting that he was now advising his clients to short the market. I watched the video in disbelief since the video appeared to be on a CNBC program of some kind. I retweeted the original post on the same day... his Tweet has since been removed but is still appearing in Google Search Results. Whether the original video was legit or not, the fact that the Tweet was removed means it was either completely false/taken out of context or "they" got pissed at the adviser for mentioning it and had the post removed.

Once major firms start to publicly advise clients to short the market, shorting is likely to become profitable in the not too distant future...

#4. Derivatives

If you are not familiar with what a "Derivative" is, READ THIS.

Once you're done reading, watch this video: Peter Schiff on Derivatives in 2010.

I define Derivatives as complex financial instruments, contracts, used to create magical investment opportunities (Hint: Magic isn't real unless Harry Potter became a Central Banker). If you need a recent example of a complex derivative market ending badly, review the history of AIG.

If you really want to be scared, review this chart: All of the World’s Money and Markets in One Visualization. Due to its size, I am NOT going to publish it on this post.

#5. FHA Increases MAX Loan Amount

If you missed this policy change on December 14th, here is a link to the news story... FHA loan limits to increase in most of U.S. in 2019... and a link to the actual letter from the US DEPT of Housing and Urban Development (HUD). I am not going to include this topic in my debt section because this credit policy change is not taking effect until 1/1/2019 and we do not know the results from its utilization.

If you do not want to read both of the above docs, here are my cliff-notes.

The FHA (Federal Housing Administration) raised it's loan limits for 2019 (starting on 1/1/2019). In high-cost areas, the new FHA loan limit ceiling increased to $726,525, up from $679,650 in 2018. The FHA will also increase its floor to $314,827, up from 2018’s $294,515.

With the slow down in the housing and construction markets in the 2nd half of 2018, I see this FHA policy change as the Centrals Bankers last gasp to squeeze the last bit of credit out of a waning market. Many Americans will see this as their opportunity to get into a larger home or for 1st time home buyers to get into a home that really should be just out of their reach.

Do not forget that in 2014, Fannie Mae and Freddie Mac announced that they would again introduce "3% down payment," conventional mortgages.

All of this sounds eerily similar to 2006-2008....

Additionally, if you speak to your local RE agent or Mortgage Banker, you will hear everyone say that "the market is slow right now." Everyone is walking on tip toes to see what happens...

I am not going to dive into the Student Loan crisis or the manipulation of Gold, Silver, etc. downward over the past few years, but they would be #6 and #7 on my list. If you need 1 more reason to think, realize that conversations like this took place around 10 years ago.

POLITICS

I believe that long term, nothing positive comes from Socialism or any Socialist form of government. Much like the 5yr old child that you tell not to touch the hot stove, post modern society does not seem to be well-informed or pay enough attention to the past to avoid future mistakes. What happens? The 5yr old does not listen, touches the stove, and burns their hand. You would think that they would learn from their mistake and choose not to touch it again, but International Politics seem to be progressing closer to socialism. If you want to dive into this discussion further, please reach out and let chat...

I did NOT vote for Trump nor did I vote for Hillary, but do believe that Trump may represent the last gasp of capitalism prior to the US conversion to more socialistic forms of governance.

We live in a growing welfare state. When more than 50% of children under the age of 18 years old reside in a home that received some form of government assistance in 2016 and you also

review the growth of the Millennial generation, you better believe that politicians will NOT be planning to get elected or reelected promising less assistance.

With the recent announcement of Elizabeth Warren's addition to the 2020 Presidential Race, be on the lookout for lots of major news stories mentioning "capitalism is bad," "taking from the poor," and "the 1%," especially with the markets correcting.

Could Trump be blamed for the down markets? You better believe it! Even though in reality, he has very little direct responsibility for the up and/or down economy.

My hope is that the Socialist Generation will grow up. If they do not, we can only hope that the socialism fetish will crash and burn faster than the Democrat's internal killing of Bernie Sanders Presidential Campaign.

There are many other topics I would love to cover including Healthcare, Rx drug Prices, Global Warming, Religion, etc., but If I make this post any longer, I will have to postpone it until 2020...

If you want to know what I suggest/recommend for your coming year based on this post, feel free to follow the instructions below..

If you want to have a constructive conversation about this or anything else, message me at dan@thrailkill.us, and let's grab coffee or a beer.

Happy New Year,

Dan